NBG publishes current tendencies of commercial banks loan portfolio and deposit

By Nika Gamtsemlidze

Thursday, January 30

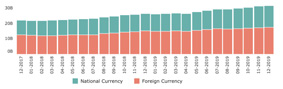

According to the report, the volume of loans issued by commercial banks (excluding interbank loans) in December 2019 increased by 558.65 million GEL or by 1.78% compared to the previous month (exchange rate effect excluded, increased by 3.41%) and constituted 31.92 billion GEL by January 1, 2020. The volume of loans in national currency increased by 319.74 million GEL (2.30%) and the volume of loans in foreign currency increased by 238.91 million GEL or by 1.37% in the same period (exchange rate effect excluded, increased by 4.30%).

By the end of December 2019, the total volume of national currency-denominated loans to resident legal entities issued by commercial banks amounted to 4.58 billion GEL (3.38% more compared to the previous month), and foreign currency-denominated loans constituted 10.67 billion GEL (2.37% more; exchange rate effect excluded volume of lending in foreign currency increased by 5.32%).

During December 2019, the volume of lending to the resident household sector increased by 1.14% or 179.07 million GEL and constituted 15.83 billion GEL by January 1, 2020.

Larization ratio for total loans constituted 44.62 percent by January 1, 2020, and increased by 0.22 percentage point (exchange rate effect excluded, decreased by 0.48 percentage point), compared to December 1, 2019.

As the report reads, the total volume of non-bank deposits in the country? s banking sector decreased by 0.08% or by 21.23 million GEL (exchange rate effect excluded volume of deposits increased by 2.01%), compared to December 1, 2019, and constituted 26.26 billion GEL by January 1, 2020. In December, the volume of term deposits decreased by 407.56 million GEL (by 3.63%; exchange rate effect excluded volume of term deposits decreased by 1.31%). Demand deposits increased by 386.33 million GEL (by 2.56%; exchange rate effect excluded volume of demand deposits increased by 4.49%).

The 'larization ratio' of total non-bank deposits constituted 36.03% by January 1, 2020, and decreased by 0.17 percentage point (exchange rate effect excluded by 0.91 percentage point) compared to December 1, 2019.

The market interest rate on term deposits constituted 6.39%. In particular, the market interest rate for national currency denominated deposits were 9.37% and the market interest rate for foreign currency denominated deposits was 2.63%.

The share of the US dollar in the total volume of foreign currency denominated deposits equals 84.25% and the share of the Euro equals 14.32%.

The National Bank of Georgia (NBG) is the central bank of Georgia. Its status is defined by the Constitution of Georgia. The main objective of the National Bank is to ensure price stability.