Foreign Direct Investment (FDI) in Georgia at a glance

By Nalifa Mehelin

Thursday, April 25

For short-run growth, saving and investment play a crucial role in the economy. Although the Solow growth model in Macroeconomics talk about long-run economic growth and discount the factor of investment rate in the long run, in the short run, the model talks about the importance of higher economic investment. In a strictly economic sense, higher saving and investment raises the rate of growth of national income and product. However, higher saving and investment rate has little or no impact to sustain growth in the long run. In the case of Georgia, the economy will need enough investment to accumulate more national capital to proceed in the later stage of attaining long-run growth. Therefore, investment, specifically FDI, has a crucial role to play. In simpler terms, when a firm or an individual from one country invests in the business climate of another country, the act is called a foreign direct investment (FDI). The investment is usually made in the currency of the country investing, rather than the country invested in.

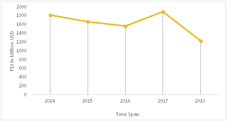

Georgia is performing really well in terms of attracting FDI. An analysis of the FDI pattern in Georgia from 2014-2018 reveals that Azerbaijan, the United Kingdom, the Netherlands, Turkey, and the United States are among the top five countries investing in Georgia. Furthermore, sectoral analysis discloses the most FDI prone sectors. With 28.4% investment share, the transport and communications sector received the most investment; followed by financial sector (12.8%), construction (12.5%), energy (10.3%), manufacturing (8.3%), real estate (6.9%), hotels and restaurants (5.8%), mining (3.7%), and other sectors (11.3%). Among the other sectors, the agricultural sector is the least attractive (0.8%). Despite facing a downward trend from 2014 to 2016, 2017 witnessed an increase followed by a sharp decline in 2018. The free trade agreements with China and the European Union (EU) are assumed to be the cause for this decline.

Georgia has earned praises for its business climate which encourages FDI. Georgia earned a 16th position in the Ease of Doing Business Index by The Heritage Foundation. The Index of Economic Freedom ranked Georgia 13th for ensuring a balanced environment for business. The renewed rules and regulations in the private sector, a liberal visa process, and the overall governance contributed significantly to boost FDI. On the other hand, Georgia needs to improve the quality of its labor force for sustainable growth.

FDI ominously contributed to expanding Georgia’s economy. It is indeed praiseworthy to grow so rapidly in such a short span of time. Rapid and far-fetched changes in policy warranted short-run growth. In the near future, it is only expected that Georgia will incur growth in the long run as well.

Nalifa Mehelin works as a foreign correspondent for The Messenger. She focuses on economic policy and development.