GEOSTAT Publishes study on Foreign Direct Investments of first quarter of 2020

By Nika Gamtsemlidze

Monday, June 15

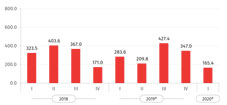

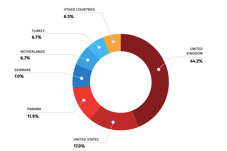

The National Statistics Office of Georgia published a study on Foreign direct investments of the first quarter of 2020. According to the study, Foreign direct investments (FDI) in Georgia amounted to $165.4 million in Q1 2020 (preliminary data), down 41.7 percent from the preliminary data of Q1 2019.

The main reasons for decreasing the FDI included completion of a pipeline project and transferring of ownership in some companies from non-resident to resident units.

The share of FDI by three major economic sectors reached 87.5 percent in Q1 2020. The largest share of FDI was registered in the financial sector, reaching $94.9 million in Q1 2020, the Real Estate sector was the second with $34.0 million, followed by the hotels and restaurants sector with $15.8 million.

The statistical data will be revised according to GEOSTATís revision policy (based on the regular revision principle) as a result of adjusting data by respondents/administrative sources.

Since March 2018 (according to the IMF recommendations), GEOSTAT has started compilation and dissemination position data for FDI in an integrated format, which allows surveyed economic units to provide GEOSTAT with the adjusted information on a regular basis. GEOSTAT uses this opportunity to update respectively statistical information in regard to ensure high quality of statistical data.

According to the study of GEOSTAT, adjusted data will be published on 17 August 2020 that may affect some changes in the existing dynamic.

The National Statistics Office of Georgia, the legal entity of public law, carries out its activities independently. It is an institution established to produce the statistics and disseminate the statistical information according to the Georgian legislation. The National Statistics Office of Georgia is established by the Law of Georgia, 11th of December 2009, on Official Statistics.

A foreign direct investment is an investment in the form of controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct control.